2023

2022

2021

2020

2019

2018

2017

2016

2015

2014

2013

2012

2011

2023

2022

2021

2020

2019

2018

2018 Program

Economic Policy Issues in Armenia

2018 Gallery

Workshop on Data in Armenia

Era of Automation (Jerbashian)

2017

2017 Program

2017 Abstracts

2017 Gallery

2016

2016 Program

2016 Abstracts

2016 Gallery

2016 Knowledge licensing in a Model of R&D-driven Endogenous Growth_Jerbashian

2015

2015 Program

2015 Abstracts

2015 Gallery

2015 Workshop Slides

2014

2014 Program

2014 Abstracts

2014 Gallery

2013

2012

2011

AEA Monthly Seminars – Joseph-Simon Goerlach (Bocconi University)

Schedule: 8-9 pm Yerevan time (5-6 pm CET; 11-12 am EST), March 27 Title: Asymmetric Shocks and Heterogeneous Worker Mobility in a Monetary Union Register …

AEA Monthly Seminars – Marija Vukotic (University of Warwick)

Schedule: 8-9 pm Yerevan time (5-6 pm CET; 11-12 am EST), February 28 Title: Bailout Incentives for Small Open Economies Register …

AEA Special Seminar – Ella Sargsyan (CERGE-EI)

Schedule: 7-8 pm Yerevan time (4-5 pm CET; 10-11 am EST), November 17 Title: Potato to the Rescue: Home Production and Child Nutrition during Deep Economic Crises Register ; …

Young Scholars Workshop 2023

The 2nd edition of the Armenian Economic Association Young Scholars Workshop will be held on November 3, 2023, in person in Dilijan, Armenia. The workshop aims to provide an opportunity for young, aspiring scholars to …

AEA Monthly Seminars – Guilherme Lichand (Stanford GSE)

Schedule: 8-9 pm Yerevan time (5-6 pm CET; 11 am – 12 pm EST), November 29 Title: Elite Capture of the Education Wage Premium: Evidence and Measurement Register …

AEA Monthly Seminars – Wladislaw Mill (University of Mannheim)

Schedule: 7-8 pm Yerevan time (5-6 pm CET; 11 am EST), October 25 Title: LinkedOut? A Field Experiment on Discrimination in Job Network Formation Register …

AEA Monthly Seminars – Alessandro di Nola (Universitat de Barcelona)

Schedule: 7-8 pm Yerevan time (5-6 pm CET; 11 am EST), September 27 Title: Taxation of Top Incomes and Tax Avoidance Register …

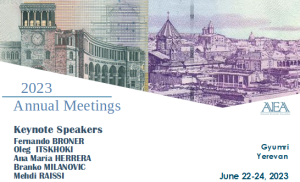

Annual Meetings 2023

The 13th Annual Meetings of the Armenian Economic Association were held on June 22-24, 2023. The Meetings were in a mixed format: The first and the second day met in …

AEA Monthly Seminars – Ioana Shipou (ESADE)

Schedule: 8-9 pm Yerevan time (6-7 pm CET), May 24 Title: The Rise of For-Profit Higher Education: A General Equilibrium Analysis Register …

AEA Monthly Seminars – Elisa Keller (University of Exeter)

Schedule: 8-9 pm Yerevan time (6-7 pm CET), April 26 Title: Spatial Misallocation of Native Labor and Immigration Register …

AEA Monthly Seminars – Khoa Vu (University of Minnesota)

Schedule: 8-9 pm Yerevan time (6-7 pm CET), March 29 Title: Higher Education Expansion, Labor Market, and Firm Productivity in Vietnam Register …

Young Scholars Workshop 2022

Register Now 5:00pm-5:40pm. Narek Ohanyan, Optimal monetary policy with external dollarization. 5:40pm-6:20pm. Hayk Sargsyan, Optimal monetary and macro-prudential policies in a world with consumer default. 6:20pm-7:00pm. Hayk Hambardzumyan, Equity Term …